After Red Hot Figma, investors say these companies may be next to the public subscription

Figma The exciting public subscription Last week, long -term discussions on public subscription prices and fixed organic pollutants on the first day – an uncomfortable reaction to newly included 333 % on the first trading days. As an autopsy the offer (With the stability of Figma shares a little, it fell 27 % on Monday), other major questions appeared: Drought public subscription? And if so, then the next?

There is a long list of VC technology companies in the late stage with strong customer bases that investment banker in Wall Street loves to announce them. Many of these companies worth billions of dollars, including Databricks, Klarna, tapeAnd SpacexThe topics of public subscription speculation were for years. Then, of course, there is a crop from startups with a rich value, from Openai and Anthroproy, to Xai’s Elon Musk.

These companies are likely to continue in the spotlight, but in the conversations they had with many investors after the first time Figma appeared, other names more vulnerable to public subscription have appeared including Canva, Drocolut, Midjourney, Dovive and Anduril.

“Ownership of positive subscriptions is a good indication of everyone,” says Kirsten Green, founder and administrative partner at Yereunner Ventures. 37 % pop on the stock price On the first day of trading. (Forerunner also has investments in the General Company HIMS & HERS and Late Stage Private, including OURA.) “I think we should reconsider this idea: General subscription is Series A in the public market – and this motivation is really on people’s willingness, and perhaps even enthusiasm for the public.” (As if it was on a braid, Heartflow, a medical technology company, S-1 for public subscription with a value of $ 1.3 billion on August 1).

Kyle Stanford, research manager on investment capital in the United States in Pitchbook, notes that only 18 companies supported by the project were published until June 30 this year. This, he says, is a factor of uncertainty in the policy that translates into the opposite winds, as well as the financing that occurred in 2021 that continues to establish investment capital. “We hope that Figma will start breaking the dam, but it was a very slow quarter,” he says.

Although Figma, which makes design programs, is profitable and has a strong set of integrated artificial intelligence capabilities, these traits are not necessary for companies associated with the success of the public subscription, says Stanford. Investors say companies prefer to generate at least $ 200 million of revenues that grow at high rates and give priority to free and positive cash flows on profitability. The presence of the story of Amnesty International is also “very important”, unless the company is very high and profitable with wide margins.

Many of the investors I met. Canva Design Cooperation Company About $ 589 million raised $ 18 with a rating of 32 billion dollars, higher than Figma’s evaluation at the time of the subscription. “Canva was a great winner when it came to what happened yesterday with Figma,” says Jason Shoman, an elementary investor for primary projects. Shoman, who is not an investor in Canva, refers to the annual CANVA revenues of 35 billion dollars and an annual growth on an annual basis by 35 % as signs of the durability of her business.

Others agree. “Canva – after looking at Figma, the sacred nonsense – will try to subscribe as soon as possible,” says Felix Wang, the administrative director and partner at Heedgye Risk Management, who is not an investor in Canva. Canva, which was recently $ 37 billion During the purchase of an arrow, you did not respond to the Fortune request for comment.

Wang and others note that the increase in Figma price, in many ways, does not actually move it. Instead, the market is at its highest level ever, causing retail traders to new companies in the market. “They do not know this company, but they know it is a new company,” says Wang of retailers who invest in Figma. “They will put some money in it, and then, more interesting: they will show it on social media.”

It was also attacked in Canva. Nubank is a weapon, the reasons for Primary’s Shuman. It looks at Fintech Nubank, which rose about 13 % of the first public subscription in early 2025 and is believed to be Revolution, which has a very similar business model, can be copied. He said a revolution luck In a statement: “Our focus does not focus on whether we or when you continue to expand business, build new products, and provide better and cheaper services to serve our growing global customer base. ”

Prime Shoman, who is investing in the vertical artificial intelligence company, B2B, SMB, Finance and Defense, says, but has no share in the brain or revolution. ((The brain S-1 was presented In September 2024, the public subscription was delayed by the organizers concerned with an investment of $ 335 million by the UAE -based G42. Now, it was cleared by the organizers to obtain the public market list, but the company has been affected by the public subscription because it is to collect donations one billion dollars, Reports Information))

Many companies, including the largest and most important Openai (which has just been arrested 300 billion dollars evaluationFor each New York Times), You have great incentives for special survival. This is because they can avoid a general scrutiny that arises from the required disclosure of public companies and access to a large special capital to pay the liquidity that is often necessary.

However, the fact that the giant such as Openai and Stripe ($ 91 billion rating) and Spacex ($ 400 billion rating) may be a special hidden cost of the public market. “I’m going to be philosophical,” says Forerunner’s Green. “Part of the public market was created so that the wider population could participate in the economy and the growth of the economy; it was not intended to sit in the hands of people.”

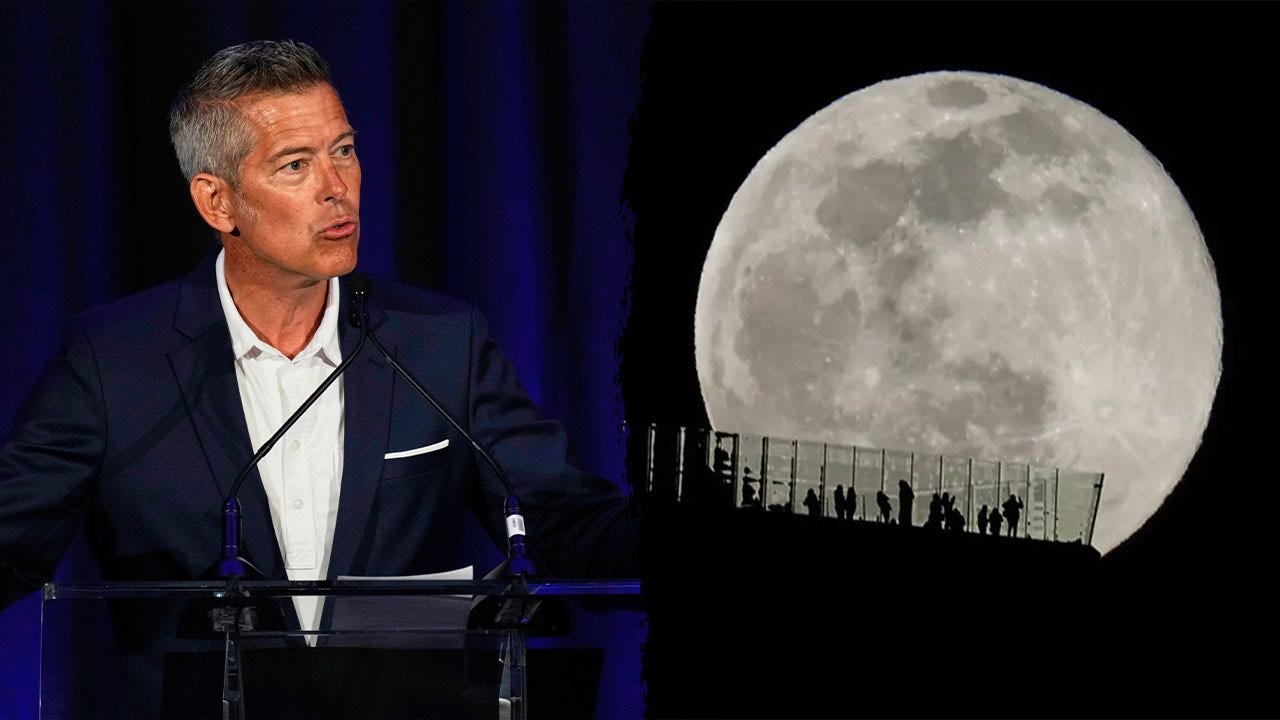

There may be one giant, which is to enter the spotlight in the stock market. Andol, Defense Technology Company This evaluation with a value of $ 30.5 billion on the G series, has incentives to survive due to the nature of its business. But Stanford of Pitchbook is expected to be the following technical public subscription. In addition to that Anduril CEO announces that he will be “definitely” being circulated publicly, the proposal of its value is the basis for the Trump administration’s priorities in security and defense, which may make it a hot choice for investors, the reasons for Stanford.

“Otherwise,” says the list of potential public subscription candidates these days is long: “Perhaps there are about 300 other companies that can be.”

Post Comment