Bank of America sees the recession, not the recession – and does not reduce its price this year. It is due to two specific policies for Trump

Bank of America Economists in research are still convinced that the federal reserve will not reduce interest rates in 2025, despite a modern wave of disappointing job data that nourishes the market to transfer the imminent policy. The reason, according to a new research note: the American economy is heading towards a battle with stagnation – not stagnation – and the rates of reducing this poisonous mixture of recession and inflation can increase.

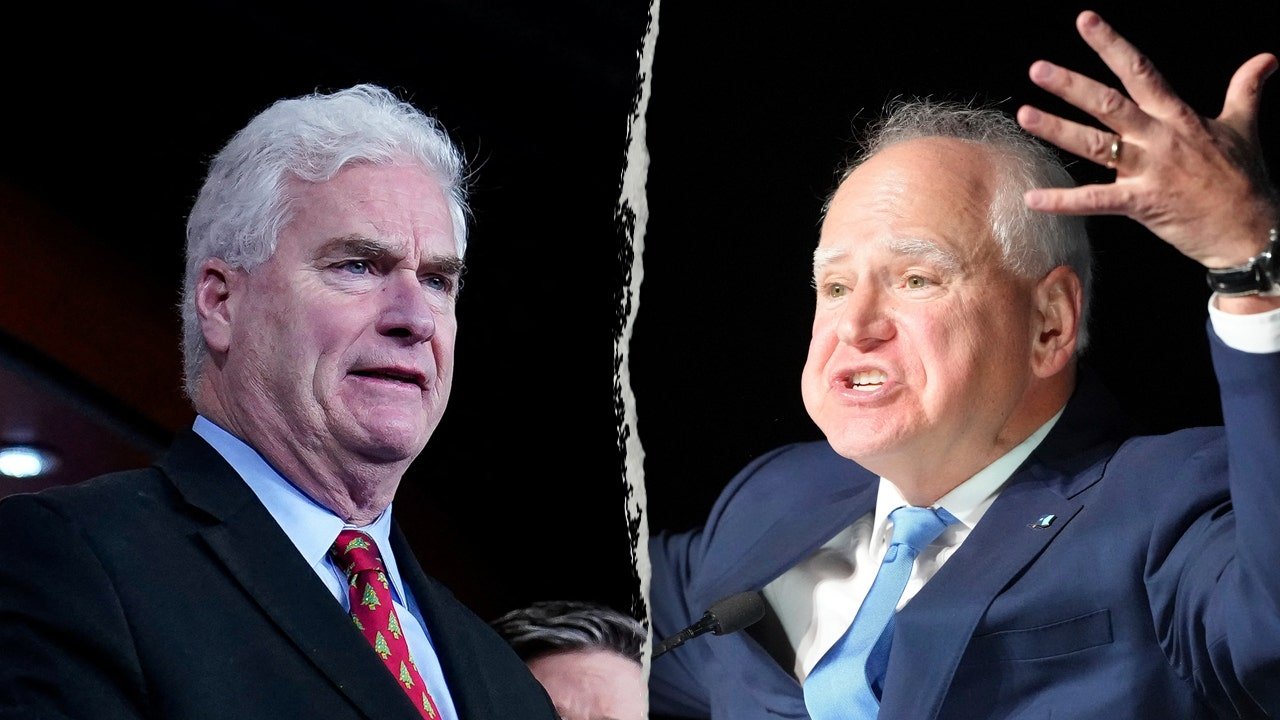

The Bofa team, led by senior American economists, was martyred with two main Trump administration policies as the main factors in their call: difficult new immigration restrictions and a new series of import tariffs.

Why is it not a stagnation, according to Bofa

First things, the Bhave team turned into Job report in July, which was astonished by Wall Street With a clear review of 258,000 salaries for May and June. This is the second largest in modern history outside the shock of the primary epidemic and the largest ever in a year -old, according to Goldman Sachs accounts. But the Bofa strategy argues that this does not spell the recession. In fact, the essence of their argument, as they say, is that “the markets confuse the recession.”

The main difference is due to Labor supply, Not only the request. Research indicates a severe shrinkage in the workforce-born workforce-by 802,000 since April-where the immigration policy has been greatly strict. This pressure on the offer is pushed against poor demand for employment, while maintaining standards that must indicate labor recession-such as the unemployment rate and the percentage of vacancies for unemployed workers-flat for the past year. Bank of America estimates that job growth, which means that the necessary employment rate to maintain unemployment will reach only 70,000 per month this year.

Boufa said that President Jerome Powell’s recent comments support this interpretation. Even if the growth of salary statements slows down to zero, the Federal Reserve is now looking at the labor market in “full employment” as long as the unemployment rate does not extend. In July, unemployment reached up to 4.25 % of 4.12 %, but remains within the levels associated.

Other economists differ with this evaluation. A team at UBS said that the labor market shows signs of “” “Stroke speed“With the average subject of 34.25 hours in July-BLOW 2019 levels and away from the usual“ expansion ”when the labor markets are narrow due to workers’ lack. Industry data also shows that job losses are not concentrated in sectors with large migratory workforce, which increases the support that the recession comes from the weak demand.

On the contrary, Bofa still believes that the demand for employment hinders, and indicates the average profit growth per hour by 3.9 % year on year in July, and increasing weekly salary statements by 5.3 %.

The discussion on the request for the offer is very important because the answer will determine how the Fed Reserve Bank responds to recession.

Bofa explained how Trump’s policies feed the fermentation mixture of stagnant growth and inflation that can return America to the 1970s.

Politics No. 1: Immigration restrictions

Trump’s migration changes have greatly suffocated work. Bofa said that this happens earlier than they expected, and they noticed that the collapse in the workforce born abroad has more than the gains of displacement between indigenous workers-although the latter is more than three quarters of the total workforce.

Bank of America research

The sectors, which rely heavily on migrant work, such as construction, manufacturing and hospitality, have witnessed impartial losses in jobs. These three represent 46,000 reviews of the Mayo and June data.

“The construction salaries have stopped this year, and manufacturing has decreased for three consecutive months, and entertainment and hospitality added only 9,000 jobs in total in May and June,” Boufa said.

This is noticeable because entertainment and hospitality were a strong place in the labor market in 2023-24.

Politics No. 2: escalating customs tariffs

The second column of the recession comes from a new round of import tariffs, especially on Chinese goods. Since July 4, the average effectiveness of the United States has jumped to about 15 %.

Economists at Bank of America warn that the customs tariff began to appear in inflation data: the prices of basic goods with the exception of cars increased by 0.53 % in June, which is the fastest in 18 months.

It is important, the underlying inherent infection in PCE remains stuck above 2.5 % – higher than the goal of the Federal Reserve. With long -term long -term expectations, policy makers are cautious to reduce rates before there is clear evidence that inflation has reached its peak. Some regional Federal Reserve heads have warned that the impact of customs tariffs may continue in the depth of 2026.

Federal Reserve Risks: It can now lead to counterproductive results

The markets currently reduce a quarter of a point by September. But Bank of America says that the discounts next month will be fraught with risks – especially if the labor market is narrow because of Supplyno Seek. Reduce rates very soon may undermine the credibility of the Federal Reserve if inflation is simply accelerating in response, which imposes a rapid reflection.

The research note concluded that unless the JOBS report in August has a sharp rise in unemployment – specifically above 4.4 % – or inflation is not expected, it is likely that the Federal Reserve Bank is likely to settle during the end of the year. Any step to reduce prices now requires “putting more belief in the expectations of the deterioration of the labor market and the effects of customs tariffs from data on hand,” the strategy writes.

For this story, luck The artificial intelligence is used to help with a preliminary draft. Check an editor of the accuracy of the information before publishing.

Post Comment