How can an activist use an elliot on how to raise return-restorn on equinox

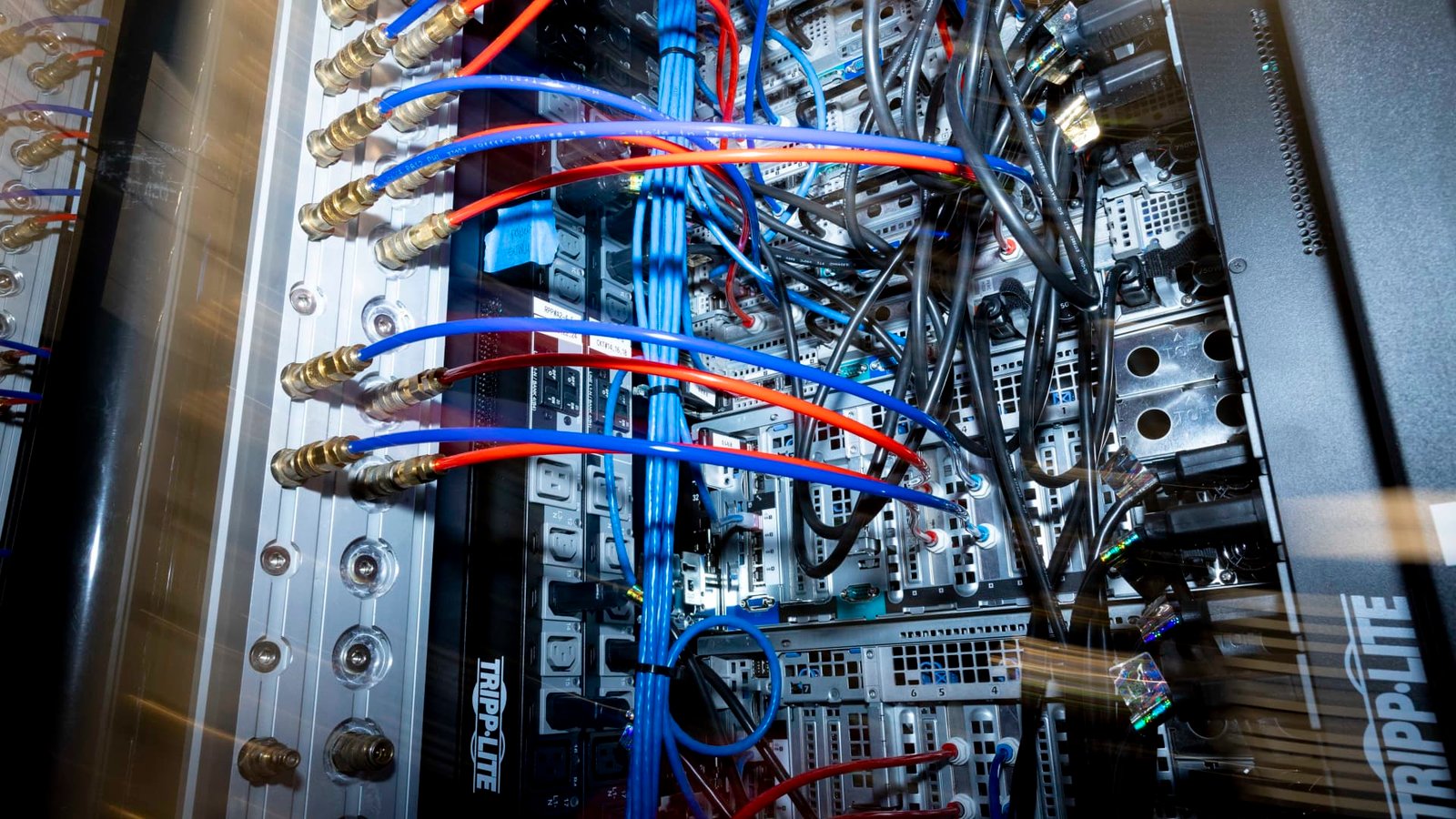

On May 9, 2024, within the internal operations of equinox at the Equinix Data Center in B Shabber, Virginia.

Amanda Andrad-Rods | Washington | Getty

Company: Equinix In (EQX)

Business: Equinix The real estate investment trust and the operator of 270 data center in 75 metro areas around the world, providing network, cloud providers, activities, and hypersecrackers, provide carrier-nutral coloction and intercourse services. The company’s platform combines the global post of the International Business Exchange (IBX) and the Axkel Data Center, which supports the customers need to implement, operate and maintain its colocheted deployment. The data centers of equinox are mainly in the US, Asia-Pacific and Europe, Middle East and Africa (EMEA) territory in the End-Yuzar market.

Stock market value: $ 75.55B ($ 771.75 per share)

Equinox shares in 2025

Worker: Elliot Investment Management

Ownership: N/a

Average price: N/a

Activist commentation: Elliot is a very successful and clever worker investor. The firm’s team includes the leading Tech Private Equity Firm, Engineer and Operating Partner – analysts of former technology chief executive officers and COOs. When evaluating an investment, the firm also appoints special and general management consultants, expert expensive analysts and industry experts. Elliot has seen companies for many years before investing and effective board candidates have a wide range of stability. Elliot has historically focused on strategic activism in the technology sector, and that policy has succeeded. However, its activation group has increased in the last several years. This firm is making a lot of administration-making activation and is creating a value from the board level at a large width of the companies.

What is happening

Elliot has taken place in equinox.

Scenes

Equinix is the RIT and Operator of the 75 data center in the 75-metro area worldwide, which provides network, cloud provider, activities and hyperseclaimers Carrier-Nutral coloction and interconnection services. Companies depend on the increasing amount of data and the most efficient solution is using cloud services such as equinox. High costs related to creating and maintaining a combined household data centers with the requirements of fluctuations can enhance cocolation companies such as equinox companies. Instead of using their own space for this purpose, the Collect Data Center allows users to rent space for their hardware. In that market, equinox located near the top end-yaser market through their global interactive data center, which has made its offer smooth for data providers. Despite this, from June 24 to June 26, the stock prices of equinox fell 17.75%. The drops were in response to the company’s analyst day, where equinix estimated to pay more than $.3 billion more than $.3 billion for 225 and estimated funding from Billion to Billion to Billion to Billion to Billion to Billion to Billion, as well as Operation (APLO) to 5% to 9%. In the past, it was 7% to 10%.

This was an opportunity in the capacity and the decline in EFA, it was an opportunity for inexperienced and short-term investors, but for experienced long-term investors such as Elliot Investment Management, it was announced that its position in equinox has increased as the company’s last 13F has exposed 0.15%. It is important to note that Illiot has a huge experience of the data center. Elliot is known as one of the most abundant workers in the investor today, but here is his experience as investors, directors and owners/operators of data center businesses. Elliot ran away A worker campaign at the data center operator switch In 2021, where investors settled for the Board seat for Jason style, the investor Eliot senior portfolio manager. During the same period, Russell finally released the switch by selling 48.33% with a return of 48.33% from 2000 to 48.33% return. But most importantly, the experience of the Elliot and the approach to the UK-based Arc Data Center from 1 to the owner and operator. It not only gives a strong unique experience, but also a more friendly relationship with a shared perspective with management.

Therefore, when the market saw a cash flow drain that would not pay for two to three years when the data center was ready and rented, investors like Elliot looked at the response to the demand. Equinox has a record booking from artificial intelligence in the past few quarters and telvinds of hyperseclasser growth. With a 5% price of capital, the caption that will offer 20% to 30% return, for the company’s long -term potential. Accordingly, EFA is expected to decrease next year, which scare short-term and low-known investors. But since the captions are deployed, it will increase by 8% in the next three years and eventually return to 9%. This will happen without any help of the Elliot. But there are some ways that the knowledge of the Illiot industry and experience can be used as an activist and operator and to increase those returns. First, equinox can communicate better in your plan market. Reacting to the company’s analyst Day, equinix can clearly benefit its captions, AI strategies and improved market communications in long -term growth estimates. Especially when the Equinix AI model training is not hosting, there is a unique opportunity to play a central role in AI infancing – or deploy AI models for the last users. As the AI is mature, the demand for inferences will increase and the key will benefit as equinox as the world’s largest third-party data center with deeply connected datasser in the And-Yasar market. The company also has the opportunity to adapt to its cost design and low interest costs. Management has already taken some steps in this direction and is targeting margins of 300 base points from 49% to 52% by 2029 – the company has set the highest target so far. However, this is still a real conservative estimate, as there are many margins, including the nearest chieftain, digital reality Trust (DRL). In addition, a little financial engineering company can reduce the interest rate and improve the AFFO of the margin equinox per-semantic growth.

Historically, the equinox has made a premium multiple commands, and its share performance is almost moved in accordance with the DRL. However, from its analytical day, the return of equinox has reduced DRL by approximately 11 percent and the company now trade 24 times 24 times Enterprise value/EBITDA Compared to 29 times for DRL. The company is on the right way, but an experienced investor like Iliat can use a little help in implementing and communicating the market. Elliot can do this with an active shareholder or board seat. We will not be surprised to see that they were invited to the Board before the next annual meeting in May 2026 due to the experience of the firm industry and the management of the management.

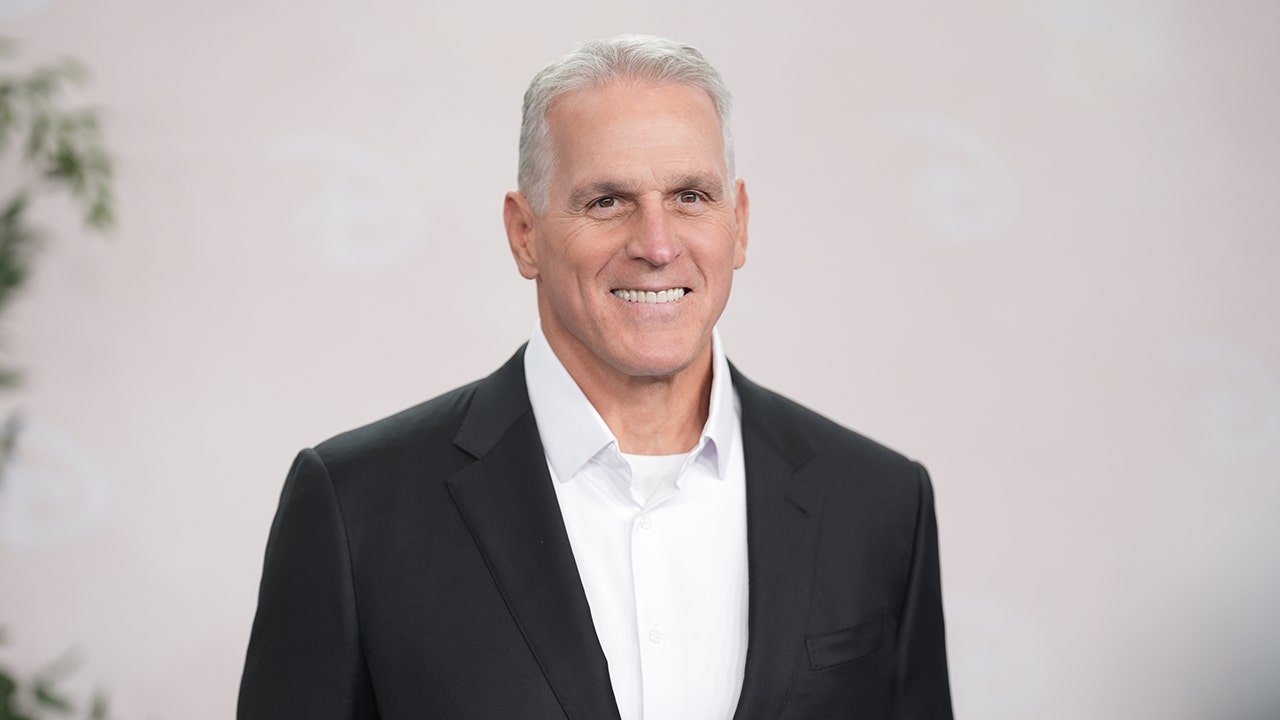

Ken Square is the founder and chairman of the 13D monitor, the institutional research services on the activation of the stakeholders and the founder of the 13D Active Fund and the Portfolio Manager, mutual funds who invest in the 13D investment portfolio.

Post Comment