Stainsbank Stakes in NVIDIA, TSMC shows the son’s focus on artificial intelligence equipment

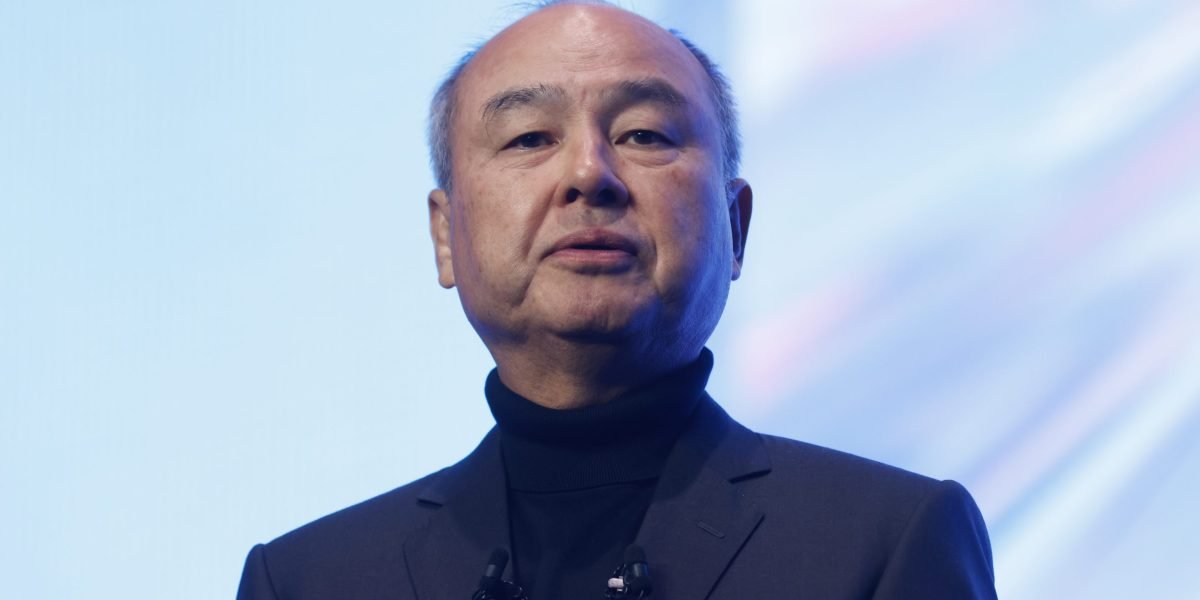

Softbank Group Corp builds stakes in NVIDIA Corp. And Taiwan Semiductor Manufacturing Co. It is the latest reflection of the Masayoshi Son focus on the tools and devices that support artificial intelligence.

The Japanese technology investor raised his share in NVIDIA to about $ 3 billion by the end of March, an increase of one billion dollars in the previous quarter, according to the regulatory files. I bought about $ 330 million in TSMC shares and $ 170 million in Oracle Corp. , It appears.

This is while the Softbank Signature Fund has achieved about $ 2 billion in public and private assets in the first half of 2025, according to a person familiar with the Fund’s activities. The person, who asked not to designate the information about discussing private information, said that the vision fund gives priority to its returns on investment, and there is no special pressure from Softbank to transfer its assets. Softbank actor refused to comment.

At the heart of AI’s ambitions in SoftBank, there is a PLC arms designer. SON gradually builds a wallet around the UK -based Cambridge company with the main players in the industry, seeking to catch up with a large extent that it has largely lost a historic gathering that made NVIDIA in a 4 trillion dollar giant and increase the TSMC contract maker near the value of $ 1 trillion.

“Nafidia is choices and shovels for the golden rush of AI,” said Bin Narasin, the founder and general partner of the public investment capital, in reference to a concerted effort by the largest technology companies in the world. He said that the American company’s share purchasing the American company may buy more impact and access to the most popular NVIDIA chips. “Perhaps he gets the line of the line.”

Softbank, who is on Thursday’s profits from this bet on NVIDIA – should benefit at least on paper. NVIDIA has gained about 90 % of the market value since it got the lowest level per year in early April, while TSMC has increased more than 40 %.

This helps compensate for many NVIDIAs after ChatGPT-is one of the largest ever. Softbank, which was early to start betting on betting on artificial intelligence long before Chatbot from Openai, separated with a 4.9 % stake in NVIDIA in early 2019 with a value of more than $ 200 billion today.

The disrupted losses in the SoftBank’s ability to be an early investor in artificial intelligence. The company’s attempts to rebuild some NVIDIA shares, along with the TSMC agent’s attempts, will help SON to restore access to some of the most profitable shares Parts of the semiconductor supply chain.

The 67 -year -old Softbank is now seeking to play a more central role in spreading artificial intelligence through comprehensive partnerships. This includes Softbank Stargate Data Center, which costs $ 500 billion with Openai, Oracle and Abu Dhabi Investment MGX. The son is also courting TSMC and others about participating in the AI Manufacturing Center with a value of $ 1 trillion in Arizona.

Since ARM’s intellectual property is used to operate the majority of mobile phone chips and is increasingly used in server chips, SoftBank can publish a unique site without a manufacturer itself, according to Richard Kay, co -chair of the stock strategy in Japan in asset management in asset management and a soft investor for a long time.

He said: “I think he sees himself as the natural provider of semiconductor technology of artificial intelligence.” “What the son really wants to do is pick up the source and the match in everything.”

Investors have chanted SON’s bold plans, while analysts say they expect Softbank to report a swing to a net income in the quarter of June. Softbank shares were distinguished by a record number last month. Softbank planned 6.5 billion dollars It is dealt with for the US company, Ampere Computing LLC, and another $ 30 billion investment in Openai, encouraging investors who see the stocks as a way to ride the start -up momentum in the United States.

However, the son is still not satisfied, according to people close to billionaire. They said Sun believes that large projects in the United States have the ability to help Softbank Leapfrog for current leaders in artificial intelligence to become a trillion dollars or larger.

The stock continues to trade with an estimated discount of approximately 40 % to the total of Softbank-which includes about 90 % in the arm at a value of $ 148 billion. The market value of Softbank is about $ 118 billion, which is part of the NVIDIA $ 4.4 trillion rating and the evaluation of other technology companies closely related to the progress of artificial intelligence.

The son, who witnessed in the past to hinder Washington, hinder the obstruction or hindrance of paths to integrate the path such as the ARM and NVIDIA Federation, to take advantage of his relationship with Donald Trump and arrange repeated meetings with White House officials. These efforts have now become very important as artificial intelligence and semi -conductors become a geopolitical flash points. Softbank plan to buy ampere facing a Investigation By the Federal Trade Committee.

The interest in quarter profits in June will be what other assets may sell to help him secure the liquidity you need to double the devices investment. The Japanese company has raised so far 4.8 billion dollars By selling some of the T-Mobile class in June. Yoshimitsu Goto’s financial manager was martyred that the net net assets of the company are of 25.7 trillion yen ($ 175 billion), saying that the company has a large capital to cover the financing needs.

In the commercial year ending in March, the exits of the vision fund included Doordash Inc. And View Inc. , Besides Cloud Security Company Wiz Inc. Enterprise Software Startup Peak, even when Softbank bought the risks in NVIDIA, TSMC and Oracle.

“We are after artificial intelligence using a group of startups and group companies,” Sun said to the shareholders in June. “We have one goal,” he said. “We will become the first platform in artificial intelligence.”

Post Comment