The bombing profits from Apple are marred by the tariff fears, slow slow, and the shares barely move

apple The explosion profits were reported on Thursday, Overcoming Wall Street’s expectations with the greatest growth in revenue since December 2021. However, the market reaction was silent, as analysts pointed to concerns about long -term issues including customs tariffs and AI.

The company reached 94 billion dollars for the quarter ending on June 28, driven by a strong call for communications, the increase in service revenues, and strong performance across international markets, which represents a 10 % increase from the same time last year. The share profits amounted to $ 1.57, which exceeds the number of analysts numbering $ 1.43. Net income increased by 12 %, while the total margin reaches 46.5 %.

Despite the positive results, the company received a low response from the investors, as its shares rise slightly more than 2 % in post -hours trading. Apple has already dealt with a difficult year, and the company’s share price has decreased by 17 % so far.

“$ 2 % shares have increased by 2 % on great news and guidelines, confirming that investors do not believe they are sustainable,” He said in X. Monster Apple shares said The story of “show” has become where investors are concerned “the definitions and organizational changes and the Apple Amnesty International’s strategy is to grow.

Definitions costs costs

It is possible that the silent reaction is somewhat dating back to Apple: Artificial Intelligence Race and President Trump’s definitions in China and India.

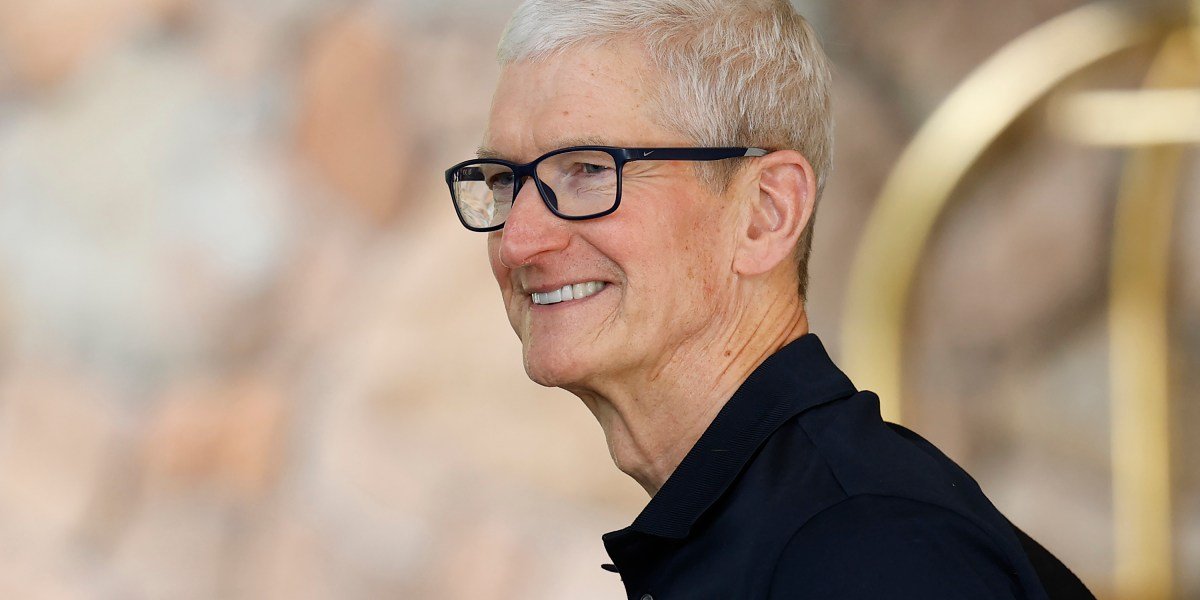

The customs duties have struck the company slightly lower than the ability previously, which cost Apple about $ 800 million instead of Tim Cook, CEO of $ 900 million in March. Cook said that the influence was mainly regarding Trump’s definitions against China, which struck “early in the year.”

Kate Lehman, chief market analyst at Avatrade luck Apples were clearly tense about the effect of more customs tariffs.

She said, “The risks on Apple are real.” “The base is coming and customs tariffs returned to the main headlines, as the United States is still closed in negotiations with China. And companies like Apple, global policy and supply chains are still very important.”

It seems that the problem of customs tariffs will get worse for the giant technology company before improving, with the expected visits in the next quarter.

“As for the quarter of September, it is assuming that the current global tariff prices, its policies and applications are not changing to achieve a quarter balance and no new tariff is added,” Cook said in a profit call on Thursday. “We appreciate the effect to add about $ 1.1 billion to our costs.”

Dan Evez described Wedbush as a “Apple problem” despite the company’s continued focusing on production in India and the fact that the majority of the iPhone devices sold in the United States are now in the country instead of China, which faced the most aggressive tariff from the Trump administration.

“The commercial policy remains unstable and unconfirmed, and Apple is fully aware of the importance of staying on the right side of the administration, fearing that it will face increasing risks and tariffs,” said Depangan Chattage, the lead analyst at Forster in Forster. “It is not surprising that Tim Cook was very special in emphasizing the continued investment of Apple in the United States and American innovation.”

Click on Apple AI

Apple has faced criticism for years for the company’s clear failure to take advantage of the artificial intelligence boom, and the latest profits of the company appear to be subjected to investors.

“Artificial intelligence is the elephant in the room,” Evz, who was less than his admiration for the company’s efforts, said in a note. “While Apple expands its investments in artificial intelligence internally, the reality is that it does not move the needle and patience wears it on investors.”

Apple has received a few times in the efforts of Amnesty International, Loss of at least four Permanent researchers in the “Superinteigence” team in Meta. In a particularly harsh blow to Apple, Dead It successfully managed to tempt the company’s Ruoming Pang, with a compensation package valued at more than $ 200 million. Visits did not help Apple’s talent in the perception that the company is behind the competitors in the area of artificial intelligence.

Evis said: “The artificial intelligence revolution is the largest technology trend in 40 years, and now you see this Apple from a park seat that drinks lemon juice while every other large technology company advances like F1 drivers who build AI and its liquefy strategy,” Evis said. “This is still the big problem of Cook as in our opinion, this is the moment of a black eye for Apple and it is the main anchor on the ship.”

Although Cook confirmed that Apple confirmed its internal investments from artificial intelligence, some investors, including IVES, hope that the company will restore some land through external partnerships or important integration and purchases. Cook It has already indicated The company was “open to integration and purchases that accelerate the road map (Apple).

Chatgegi described the company’s “clear” urgency and has “a calm acceptance of its court to admit that it may have to rely heavily on the acquisition of time tables.”

Some investors hope that Apple gets the baffled intelligence, a fast -growing search company as a potential starting point for Siri repair and closing AI’s AI’s gap with competitors like Google and Microsoft.

“The rumors revolve around the confusion, and if that will happen, this may lead to the speedy upcoming promise of a more effective Siri,” said Chatgeji.

Post Comment